Do not put this in the PPS title!

Hi, just pinged my most recent post and to my horror, it has no title! It was supposed to be "< RM15 Domains". I didn't mean to do that but I think I know what's the reason:

- ">" = >

- "<" = <

Hi, just pinged my most recent post and to my horror, it has no title! It was supposed to be "< RM15 Domains". I didn't mean to do that but I think I know what's the reason:

Was trying to buy a domain last night and tried searching around for one. My normal choice is GoDaddy but this time I decided to shop online for a cheaper one and guess what I found:

Well...was playing again with IE7 today and since I was so used to Opera, I entered this in the address bar:

Well...was playing again with IE7 today and since I was so used to Opera, I entered this in the address bar:

g where can i find the boringest blog

This in Opera would mean that you would like to search "where can i find the boringest blog" in Google. Guess what happened in IE7 -> it went to the MSN Search site searching "g where can i find the boringest blog"!

So, now after learning that you can actually set other search engine as your default, I tried using Google, Yahoo! Search, Ask Jeeves and AOL Search and they all work!

Then, I tried figuring out how to make IE7 not to search "g" instead but just the search term itself and I found 2 commands that allow you to do so:

go where can i find the boringest blog

and

search where can i find the boringest blog

So, there you go - a new function for IE7 - address bar searching. Also say if you type in a domain that nobody has e.g. ilovetheboringestblog.com, normally you'll arrive in a page that says "Could not locate remote server" but IE7 will goto your default search engine instead, quite smart i think.

Also, finally IE7 supports transparent PNGs as you can see on my "XML Feed Me" button on the sidebar, where some greyish-white tip will appear at the edges of the button in IE6. Finally, after reading the official technical overview, it seems that the features in IE7 are not complete yet and there'll definitely be improvements in the CSS department.

I might be a bit late with this piece of news but Boeing has just finalised the exterior look of the 787. From my limited experience with aircraft design, this is a crucial step as it would allow the component designers, especially the structural engineers to optimise and finalise their calculations. Now, let's see what has changed from the super-sexy 7E7 to the current not-so-sexy-but-still-pretty-sleek 787.

The picture on the top is the original 7E7 and the one below it is the final design of the 787. The most obvious changes are:

The picture on the top is the original 7E7 and the one below it is the final design of the 787. The most obvious changes are:

Note the wings which are deflecting so much. Engines are huge!

Note the wings which are deflecting so much. Engines are huge!

The winglet design (stuff at the wing tip) seems to have changed as well.

The winglet design (stuff at the wing tip) seems to have changed as well.

Main difference between 787 and other planes would be the sweep angle of the wing, which is quite high.

Main difference between 787 and other planes would be the sweep angle of the wing, which is quite high.

The nose seems sharper from the bottom view and the wings seem to be quite narrow, but could be due to the bigger sweep angle.

The nose seems sharper from the bottom view and the wings seem to be quite narrow, but could be due to the bigger sweep angle.

IE Sucks? Let's see what Microsoft has in store for us. It's a 10MB installation file which is quite big compared to Firefox (4.8MB)/Opera (3.8MB) but once installed everything seems to run quite smoothly and it seems faster too (not too sure about this, but could be b'cos I haven't used IE for so long after meeting Opera).

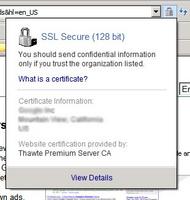

Immediately, you'll be able to see a few new features - most notably the:

Immediately, you'll be able to see a few new features - most notably the:

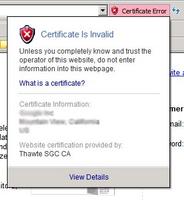

and non-certified websites like this:

and non-certified websites like this:

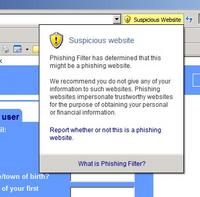

So, in order to see how far they have gone in the Beta version, I went through my collection of spam mail and tested a phishing email as shown below:

So, in order to see how far they have gone in the Beta version, I went through my collection of spam mail and tested a phishing email as shown below:

And it works! A yellow icon that says "Suspicious Website" will pop up next to the address bar:

And it works! A yellow icon that says "Suspicious Website" will pop up next to the address bar:

Not too sure about the numerous security holes but all in all, the beta version of IE7 looks promising, but more work has to be done, especially to allow support for ATOM feeds, a new button for "New Tab" should be included as well (see top picture) and an option to remove one of the toolbars, leaving just the address bar and tabs to allow more viewing space would be good as well.

Not too sure about the numerous security holes but all in all, the beta version of IE7 looks promising, but more work has to be done, especially to allow support for ATOM feeds, a new button for "New Tab" should be included as well (see top picture) and an option to remove one of the toolbars, leaving just the address bar and tabs to allow more viewing space would be good as well.

On the other hand, a quick look in MSN Sandbox shows a few interesting developments, notably "Start" - a personalised homepage very similar to Google's which I think could be the new Start page for IE7. Looks pretty cool though and it uses AJAX.

On the other hand, a quick look in MSN Sandbox shows a few interesting developments, notably "Start" - a personalised homepage very similar to Google's which I think could be the new Start page for IE7. Looks pretty cool though and it uses AJAX.

Only less than 5 visits to see my 'Greed is Good?' article! Guess I shouldn't write anymore financial stuff...anyway, I'll give you guys something more boring - my summer job in the lab: Further to my post on Mesothelioma, I finally got the chance to work with somewhat dangerous substance now in my lab -> carbon-fibre/glass-fibre composites. The material itself is not dangerous but the dust produced when cutting/machining it is so fine and turns out needle-like, once it gets into your lungs, you might lose a few alveolis/which might eventually lead to Mesothelioma perhaps! So, being a newbie at this, I had to attend a lecture yesterday by one of the workshop technicians on how to operate the machines properly and since I have to wait now while they have their tea-break (which happens 2x a day, for about 45 mins each, not including lunch) and work on some of the contract stuff, I'll be blogging about this =P Didn't take any pictures 'cos I'm not sure if I have the right clearance to do so but here goes: I was supposed to be using one of the wet saws with diamond-tipped blades to cut the materials which would then make it safer for me since dust won't be flying around but gets washed away by the coolant. But somehow after the technician demonstrated the thing to me and asked me to try, the machine broke down! As a result I had to resort to using the dry saw, which is diamond-tipped as well + it's not automated (which means I have to use my hands to push the material into the blade hence risking one/more of my fingers if I wasn't careful) + the dust will be flying around. So, the technician asked me to wear a dust mask and at first I thought, it would look like the ones ppl wear during SARS:

and then he said no, then I thought it was the ones used during a chemical attack:

and then he said no, then I thought it was the ones used during a chemical attack:

then he said it's similar and finally took it out to show me (the one in my lab looks way cooler, but can't find the pic of it):

then he said it's similar and finally took it out to show me (the one in my lab looks way cooler, but can't find the pic of it):

Cool huh? Maybe I'm jakun but this is the 1st time I see something like this. There's a small motor that sucks in air from outside through a filter as well and when you wear it you feel a nice vibration around your whole head. Anyway, searched it online and here's a picture to show you how it works:

Cool huh? Maybe I'm jakun but this is the 1st time I see something like this. There's a small motor that sucks in air from outside through a filter as well and when you wear it you feel a nice vibration around your whole head. Anyway, searched it online and here's a picture to show you how it works:  Come to think of it, the helmet in my lab looks something like this when the visor's pulled up...hehe:

Come to think of it, the helmet in my lab looks something like this when the visor's pulled up...hehe:

Missed writing about the market at the beginning of the week. Nevertheless, I'll start from mid-week. My trades are predominantly based on the USD, so I'll only be writing about the GBP/USD and the EUR/USD pairs. I tend to use a mix of fundamentals and technicals in my trades (rojak =P)!

Mid-week USD outlook: Bullish

A further tightening of the US monetary policy is expected. Greenspan's clear announcement last week that the tightening rate will continue (i.e. increasing interest rates thus giving the USD a firm tone, reinforcing the USD's yield advantage), underpinned by waves of bullish data this month (e.g. today's Durable Goods data was stronger than expected) has made traders to be in favour of the USD.

Also news that IBM is planning to repatriate about USD$9B usd in foreign earnings, taking advantage of the temporary repatriation incentive from the American Jobs Creation Act is holding the USD up.

Today's US Federal Reserve's Beige Book is expected to paint a rosy picture of economic conditions across the country, and to cement expectations of further interest rate hikes to come. Watch out for this Friday's Real GDP figures though!

Now to the currency pairs, outlook for this mid-week onwards:

GBP/USD - Bearish!

Recent terrorist attacks, expectation of an interest rate cut in August, slowdowns in UK spending, stagnating housing market prices, cooling in the labour market and contracting manufacturing sector - things don't look too good for the mighty British economy!

Analysts have expected the rate to go under 1.70 in Auguest if this conditions continue. Technicals seem to suggest the same sentiment as well.

GBP/USD - Bearish!

Recent terrorist attacks, expectation of an interest rate cut in August, slowdowns in UK spending, stagnating housing market prices, cooling in the labour market and contracting manufacturing sector - things don't look too good for the mighty British economy!

Analysts have expected the rate to go under 1.70 in Auguest if this conditions continue. Technicals seem to suggest the same sentiment as well.

EUR/USD - Neutral

The pair was fighting it out at the 1.20 level yesterday and even with a strong German IFO business sentiment survey (which suggested that the worst may be over for the EU economy) which causes a sharp hike for a moment resulted in a drop down again to the 1.20 zone. Also somewhat in an odd way, the ECB reported a substantial forex reserves decline of EUR$1.2B without any explanations - huh? Could be the summer effect, traders get a bit disoriented during this harsh period =)

Hard to pinpoint any direction from technicals/fundamentals, so I'll have to say it's neutral.

On the Ringgit issue, read this well-written article: Link

Finally to end on a funny note, with the Yellow/White/Pink/Purple bands you see around to promote something, check the Greed Band out! Yes - like Gordon Gecko said "Greed is Good"!

DISCLAIMER: All this are only boringest's views/opinions and do not qualify as investment advice/recommendations. It is not a production of my employer, and is unaffiliated with any FX broker/dealer. The information on this site is provided for discussion purposes only, and are not investing recommendations. Under no circumstances does this information represent a recommendation for FX trading.

EUR/USD - Neutral

The pair was fighting it out at the 1.20 level yesterday and even with a strong German IFO business sentiment survey (which suggested that the worst may be over for the EU economy) which causes a sharp hike for a moment resulted in a drop down again to the 1.20 zone. Also somewhat in an odd way, the ECB reported a substantial forex reserves decline of EUR$1.2B without any explanations - huh? Could be the summer effect, traders get a bit disoriented during this harsh period =)

Hard to pinpoint any direction from technicals/fundamentals, so I'll have to say it's neutral.

On the Ringgit issue, read this well-written article: Link

Finally to end on a funny note, with the Yellow/White/Pink/Purple bands you see around to promote something, check the Greed Band out! Yes - like Gordon Gecko said "Greed is Good"!

DISCLAIMER: All this are only boringest's views/opinions and do not qualify as investment advice/recommendations. It is not a production of my employer, and is unaffiliated with any FX broker/dealer. The information on this site is provided for discussion purposes only, and are not investing recommendations. Under no circumstances does this information represent a recommendation for FX trading.

Basically I.C.E. = In Case of Emergency

Read about this in London where the UK paramedics are encouraging handphone owners to store the emergency contact details as ICE in your handphone contact list, so that in case you fainted/unconscious/delusional, etc, the hospital staff would still know who to contact provided your handphone's still with you. Thought it's a pretty simple concept which should be implemented in Malaysia as well.

If you have more than 1 ICE contact, just put ICE1, ICE2, etc...

Link

*Just read at another site which uses the same title as mine..coincidence I guess, anyway, I think I should link there as well just in case...

Basically I.C.E. = In Case of Emergency

Read about this in London where the UK paramedics are encouraging handphone owners to store the emergency contact details as ICE in your handphone contact list, so that in case you fainted/unconscious/delusional, etc, the hospital staff would still know who to contact provided your handphone's still with you. Thought it's a pretty simple concept which should be implemented in Malaysia as well.

If you have more than 1 ICE contact, just put ICE1, ICE2, etc...

Link

*Just read at another site which uses the same title as mine..coincidence I guess, anyway, I think I should link there as well just in case...

Been looking at the stats of my websites and I've been wondering why so few use Opera as their browser of choice!

This is honestly the best browser that's available on the planet right out of the box!

Why?

1. Speed - Time is money, so why not choose a browser that'll save you time!

Here are some comparisons made on the same computer with no tweaks made on both browsers:

A Javascript test from 24fun:

Opera: 5.77 seconds

Opera: 5.77 seconds

Firefox: 9.95 seconds

~1.7x faster than Firefox on the same computer!

Next, Opera has a smart rendering system (a combination of deliberate FOUC rendering) which gives higher priority to the loading of text and hence readable content will appear faster. See the next set of pictures to see how big the difference is:

Firefox: 9.95 seconds

~1.7x faster than Firefox on the same computer!

Next, Opera has a smart rendering system (a combination of deliberate FOUC rendering) which gives higher priority to the loading of text and hence readable content will appear faster. See the next set of pictures to see how big the difference is:

15ms on Opera vs 5782ms on Firefox! 384.5 x faster!

You can test your browser here.

2. Mouse Gestures - the feature that convinced me that Opera's the one for me. This feature has been available on Opera browsers since 2001 in version 5 and furthermore it's configurable! What this does is it allows you to 'draw' an imaginary diagram on the screen using the mouse while holding down the right mouse button and it activates a command:

Frequently used Mouse Gestures by me:

15ms on Opera vs 5782ms on Firefox! 384.5 x faster!

You can test your browser here.

2. Mouse Gestures - the feature that convinced me that Opera's the one for me. This feature has been available on Opera browsers since 2001 in version 5 and furthermore it's configurable! What this does is it allows you to 'draw' an imaginary diagram on the screen using the mouse while holding down the right mouse button and it activates a command:

Frequently used Mouse Gestures by me:

Source: China Revaluation

A lot has happen in the past 24 hours - China revaluates the yuan and announcing plans to move into a basket of currencies, bombings again in London, largest fall in US jobless claims and Malaysia follows suit with China by unpegging the Ringgit!

Wow! So what does this mean to us plain folks?

While others are worried about their reduced Adsense earnings, the Bank Negara stepping in to prevent a rapid appreciation, this is what I gather after reading the reports. Of course, there's no right or wrong to this, since we can't see the future:

1. Oil prices will go down - Why? China is one of the largest importer of oil, so naturally when the yuan strengthens, China exports get more expensive and ppl think this will slow down the economy. This should happen in the medium term as things will go back to its previous state considering China's rapid economy growth. However, there's a countering argument since oil is priced in US dollars, crude oil will be realtively cheaper for Chinese importers. Thus, they'll buy more now and drive oil prices up.

2. +1 to China diplomatic relations - By revaluing the yuan, this gives a clear signal that China's a cooperative trade partner and shows a growing maturity of the Chinese economy.

3. Malaysia made the right choice in unpegging the Ringgit - With total exports of about $123.5 billion and $26.25 billion in that to China (~21%) makes our economy quite reliant on China. If we have stayed on the 1USD = RM3.8 peg, we would have make huge losses in trade, while unpegging it and making sure that it stays within a certain trading band comparable to China makes perfect sense to me.

4. Expect Chinese corporations to venture out of China now - with reports of China trying to gain favour to get approval for deals such as Unocal (an American oil company), this might eventually be true.

As I speak/write, the USD is rising against the major currencies - GBP, EUR, JPY.

Source: China Revaluation

A lot has happen in the past 24 hours - China revaluates the yuan and announcing plans to move into a basket of currencies, bombings again in London, largest fall in US jobless claims and Malaysia follows suit with China by unpegging the Ringgit!

Wow! So what does this mean to us plain folks?

While others are worried about their reduced Adsense earnings, the Bank Negara stepping in to prevent a rapid appreciation, this is what I gather after reading the reports. Of course, there's no right or wrong to this, since we can't see the future:

1. Oil prices will go down - Why? China is one of the largest importer of oil, so naturally when the yuan strengthens, China exports get more expensive and ppl think this will slow down the economy. This should happen in the medium term as things will go back to its previous state considering China's rapid economy growth. However, there's a countering argument since oil is priced in US dollars, crude oil will be realtively cheaper for Chinese importers. Thus, they'll buy more now and drive oil prices up.

2. +1 to China diplomatic relations - By revaluing the yuan, this gives a clear signal that China's a cooperative trade partner and shows a growing maturity of the Chinese economy.

3. Malaysia made the right choice in unpegging the Ringgit - With total exports of about $123.5 billion and $26.25 billion in that to China (~21%) makes our economy quite reliant on China. If we have stayed on the 1USD = RM3.8 peg, we would have make huge losses in trade, while unpegging it and making sure that it stays within a certain trading band comparable to China makes perfect sense to me.

4. Expect Chinese corporations to venture out of China now - with reports of China trying to gain favour to get approval for deals such as Unocal (an American oil company), this might eventually be true.

As I speak/write, the USD is rising against the major currencies - GBP, EUR, JPY.

Found this lying somewhere, so I thought I might as well share it: High Paying AdSense Keywords Detailed List Keywords | Cost/Click $50 - $100 mesothelioma $84.08 mesothelioma attorneys $80.93 mesothelioma lawyers $69.04 malignant pleural mesothelioma $55.95 Asbestos Cancer $54.17 mesothelioma symptoms $53.66 peritoneal mesothelioma $52.27 trans union $51.91 $20 - $50 lung cancer $43.12 search engine optimization $30.19 mesothelioma diagnosis $28.70 home equity loans $20.06 $10 - $20 baines and ernst $18.47 consolidate loans $17.74 lexington law $17.68 lexington law firm $16.81 debt problems $16.28 register domain $15.74 home equity line of credit $15.61 affiliate programs $14.33 refinance $14.21 video conferencing $13.63 payday loans $13.21 credit counseling $13.02 asbestos $12.79 debt solutions $12.64 cash loans $12.13 refinancing $12.09 broadband phone $12.08 debt management $11.86 fast loans $11.81 credit card processing $11.75 credit reports $11.59 making money on the internet $11.58 merchant account $11.46 line of credit $11.42 money magazine $11.27 adsense $11.13 credit counselors $11.02 identity theft $11.00 make money at home $10.84 free credit $10.76 cash advance $10.64 consumer credit counseling $10.63 freecreditreport $10.61 make money from home $10.35 free credit reports $10.26 make extra money $10.21 domain registration $10.19 adwords $10.08 citifinancial $10.06 my fico score $10.01 $5 - $10 web hosting $09.88 american express credit $09.71 airlines credit card $09.52 credit report $09.52 earn money $09.51 hard drive recovery $09.49 hard money lenders $09.44 credit counseling service $09.44 consolidate $09.41 claims $09.20 debt consolidation $09.10 poor credit $09.09 low interest $08.89 web host $08.64 student credit cards $08.63 secured $08.60 merchant account application $08.59 loans $08.57 send money to india $08.43 discover credit $08.40 merchant accounts $08.39 hosting $08.35 money on the internet $08.34 credit loans $08.33 consumer credit $08.32 money making ideas $08.26 credit card applications $08.23 money lenders $08.10 discover credit card $08.09 money loans $08.08 dept help $08.01 credit card services $08.01 consolidation $07.94 ways to make money $07.84 student credit $07.73 online credit report $07.66 how to make money $07.51 accept credit $07.47 accept credit cards $07.43 student loan $07.43 internet money $07.39 credit repair $07.32 free credit check $07.28 bad credit $07.26 money making $07.21 SEO $07.18 University Degrees Online $07.16 credit card application $07.05 consolidating $07.05 people with bad credit $07.05 car loans $07.05 money fast $07.03 money now $06.88 household automotive $06.76 personal credit $06.73 money at home $06.72 bad debt $06.69 lenders $06.68 auto loans $06.63 making money online $06.61 Point of sale software $06.55 interest credit cards $06.53 credit history $06.53 lending $06.39 business credit $06.32 money to india $06.31 debt $06.17 online credit $06.15 student credit card $06.14 hard money $06.10 webhosting $06.06 credit cards $06.04 make money $05.97 credit application $05.96 online credit card $05.96 chase credit $05.90 interest credit $05.89 equifax credit $05.89 video conference $05.88 credit card offers $05.88 american credit $05.86 credit card fraud $05.82 best credit card $05.82 no credit check $05.79 credit card $05.75 bankruptcy $05.64 best credit $05.59 money market account $05.55 mbna credit $05.54 for credit $05.48 webhost $05.48 pengar $05.47 college credit $05.44 money market accounts $05.43 best credit cards $05.40 credit reporting agency $05.39 credit card debt $05.36 credit checks $05.36 visa credit $05.36 credit check $05.29 secured credit cards $05.26 one credit card $05.25 Credit report $05.24 i need money $05.16 low interest credit $05.15 credit services $05.08 credit reporting $05.06 preapproved $05.04 online approval $05.04 credit card rates $05.02 credit score $05.00

We're often tricked by the news/fundamentals when trading FX. Thus, I have tried to note down the 14 major fallacies that we meet everyday. This is from Jack Schwager's "A Complete Guide to the Futures Markets". 1. Viewing Fundamentals in a Vacuum 2. Viewing Old Information as New 3. One Year Comparisons 4. Using Fundamentals for Timing 5. Lack of Perspective 6. Ignoring Relevant Time Considerations 7. Assuming that Price Cannot Decline Significantly Below the Cost of Production 8. Improper Inferences 9. Comparing Nominal Price Levels 10. Ignoring Expectations 11. Ignoring Seasonal Considerations 12. Expecting Prices to Conform to Target Levels in World Trade Agreements 13. Drawing Conclusions on the Basis of Insufficient Data 14. Confusing the Concepts of Demand & Consumption

I'm all new to this blogging thing. Anyway, this is my 2nd time adding the Haloscan trackback system and the previous time I deleted this default post, the trackback controls were deleted as well. So I'll leave this here then =) Haloscan commenting and trackback have been added to this blog.